- Santander Pay In Cheque App Uk Account

- Can I Pay In A Cheque Using Santander App Uk

- Santander Business Pay In Cheque App Uk

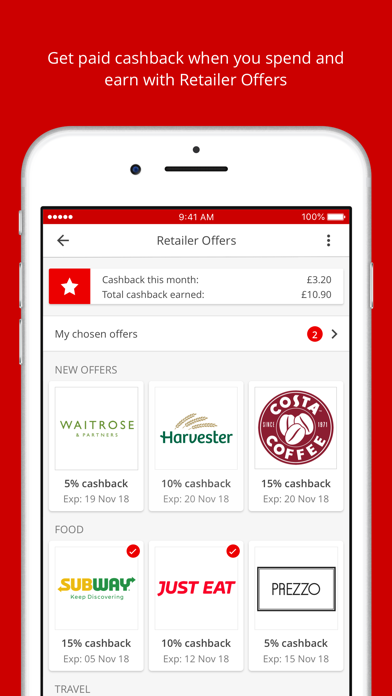

Payment by Cheque. Please send your cheque to: Santander Consumer Finance Santander House 86 Station Road Redhill Surrey RH1 1SR. Please make your cheque payable to Santander Consumer (UK) plc. To ensure your payment gets allocated to the correct agreement please put your agreement number on the reverse of the cheque. The most inflexible banks are Santander, M&S Bank, HSBC and First Direct. Customers who don’t use a mobile will have to call their banks using a landline to go through the final stages of the online purchase process. Santander said customers can also access accounts and make payments in their branch. Unfortunately there isn’t an option for you to pay in cheques using your mobile app or Online Banking. If you want to deposit a cheque you can do so through one of our branches or your local Post Office. Information on branch closures and opening times: NatWest branch locator Find your nearest branch using our branch locator (opens in a new. A lot of people get frustrated here as when you search “Pay in a cheque Santander” on Google you’ll get results from the US arm of the bank. Sadly in the UK there isn’t this feature. Also, for the Post Office option you’ll need to order some paying-in slips and deposit envelopes from Santander in advance.

You’re already doing pretty much everything on your phone, whether it’s connecting with friends or colleagues or paying bills through your mobile banking app. But are you using mobile check deposit?

There are many benefits to utilizing the mobile check deposit functionality – we’ve listed out top three below.

1. Because your time is important.

Your time is valuable, and unless you need to talk to a banker about other financial concerns, you don’t want to waste yours getting to a bank branch or ATM. Depositing your check by phone is fast, and can be done almost anywhere – as long as you have cell service or Wi-Fi!

2. Because you don’t want overdraft fees.

Look, nobody likes fees. If you’re not able to get to the bank in the near future but you still have expenses coming up, like your rent or your monthly Netflix payment, now’s the time to mobile deposit any outstanding checks you have. That way you’ll have enough time to get funds into your account, and hopefully avoid any overdraft fees when it comes time to make your next payment.

Not sure if your balance is low? You can go ahead and set up mobile alerts to make sure you’re always informed.

3. Because you’re on the go.

Even if you’re out of town, that doesn’t mean your bank account is out of reach. Maybe you’re visiting family for the holidays and you got a check from your favorite aunt. Or, you’re attending a school far from home and somebody paid you by check. You don’t want to wait to get home to be able to access your cash! Even if you’re not in the same ZIP code as your bank, it doesn’t mean you have to put your life on hold. Use mobile deposit to get your funds, faster.

How long does mobile deposit take?

Mobile check deposit takes only a few minutes. But there is processing time involved, just like any deposit. If you’re banking with Santander, when you deposit a check before 10 pm on a business day, it counts as being deposited on that day. You’ll be able to access up to $200 of the amount you deposited the next business day, however you won’t be able to access the rest of the deposit amount until the check clears. This usually happens within two business days of the deposit.

How does mobile deposit work?

Mobile deposit works simply—just point, click and confirm. Take a picture of your check through your bank app and click through the steps on screen. You’re all done! Learn how to download our app and get started with Santander mobile check deposit.

To use the Santander Mobile Banking App, you must first accept the Online Banking Agreement. Data connection required. Message and data rates may apply.Mobile deposits are subject to limits and other restrictions. Refer to the Online Banking Agreement for details.

The days of waiting nearly a week for a cheque to clear could soon be over, as a new system introduced yesterday aims to revolutionise one of the more old-fashioned payment methods.

New technology launched by the Cheque & Credit Clearing Company means cheques paid in on a weekday could soon clear before midnight the following evening, rather than taking up to six working days.

From early next year, some banks will even allow you to pay in cheques using their mobile banking apps.

Cheque imaging: how will it work?

With the new technology, the old paper-based clearing system will be phased out. Instead, the bank will create a digital image of the cheque, so that each payment can be processed more quickly.

While the new clearing system officially launches today, banks have until summer 2018 to fully adopt the new technology.

Once they do, it’ll work like this: if a customer pays a cheque in on a weekday, it’ll be cleared by 11:59pm the following day at the latest. Over a weekend or bank holiday, the cheque will clear by the following working day. Once the system is fully rolled out, payments may move even more quickly.

Some banks are also set to offer cheque imaging through their online banking apps – meaning you might soon be able to pay in a cheque from the comfort of your own home.

What will happen in the meantime?

While the new system is in the process of being rolled out, the old clearing system will operate parallel to it. Initially, imaging will only be available to a small number of cheques before growing gradually over the coming months.

In the short term, this means you might face some uncertainty over how long a cheque will take to clear, as some will still take up to six working days using the old paper method.

For now, customers are being advised to contact their bank to find out when they’ll be adopting the new technology. But don’t worry – you’ll still be able to pay cheques in at your bank or building society branch, using an ATM or by post.

Which banks are leading the change?

Bank of Scotland, Barclays, Halifax, HSBC, Lloyds, Nationwide and Santander are front-runners in adopting the new clearing system from today, with NatWest and RBS set to follow early in 2018.

Santander Pay In Cheque App Uk Account

While Barclays already allows customers to deposit cheques worth £500 or less using its app, this service is currently limited to Barclays cheques.

None of the major banks are currently accepting competitor cheques through their apps, though this will change in early 2018, with Bank of Scotland, Barclays, Halifax and Lloyds all expressing an intention to be early adopters.

Do people still use cheques?

In 2011, the banking industry announced plans to phase cheques out entirely by 2018 – but it’s safe to say that’s unlikely to happen.

Can I Pay In A Cheque Using Santander App Uk

Partly, this may be due to pressure from MPs, who suggested older people still rely on cheques as a day-to-day form of payment.

Santander Business Pay In Cheque App Uk

While it’s true that cheque usage might be in decline, a whopping 477 million were written in 2016 – meaning the days of the humble cheque are unlikely to be over anytime soon.